Macro Developments and Banking System Trends in Russia

Due to the number of acquisitions completed in 2012, some of the key financial metrics for the consolidated group are not directly comparable to the 2011 figures. For this reason, the data in this section of the Annual Report refers to OJSC Sberbank of Russia on a standalone basis via both Russian Accounting Standards and management accounting data, if not specifically noted otherwise. Key financial results and figures relating to the Group’s major subsidiaries are disclosed and discussed in the section Financial Results of Key Subsidiaries.

A gradual deceleration in the Russian economy

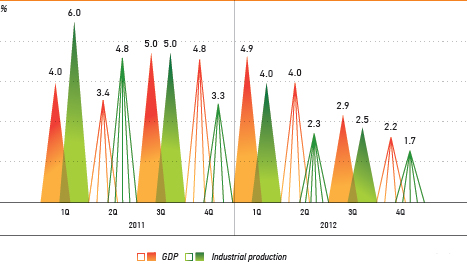

The Russian economy saw a significant slowdown in 2012, quarterly growth rates decelerating from 4.9% in 1Q12 to 2.2% in 4Q12. This trend was driven by a combination of both internal and external factors, with turbulent global markets and declining domestic investment activity among the key factors.

GDP AND INDUSTRIAL PRODUCTION GROWTH IN 2011–2012

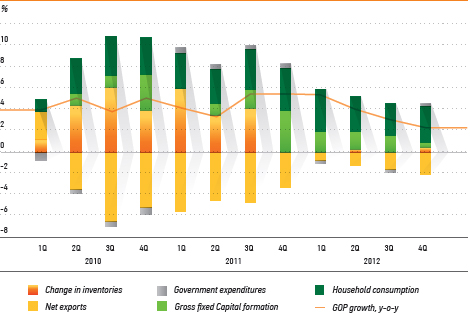

COMPOSITION OF GDP GROWTH

Among key GDP components, only final consumption drove the growth, while all other factors offered negligible contributions to GDP growth. In such an environment, it is no surprise that the Russian banking system saw a significant decline in demand for corporate loans, annual growth therein falling from 26% in 2011 to 13% in 2012.

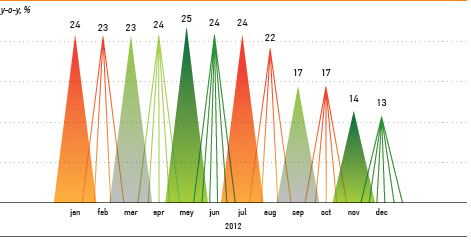

CORPORATE LOAN BOOK GROWTH IN RUSSIAN BANKING SYSTEM

Among other factors that contributed to slower lending growth was a rapid development of the local bond market and the favorable conditions in external debt capital markets, which both allowed major Russian corporate borrowers to source significant amounts of debt financing outside of the traditional loan market.

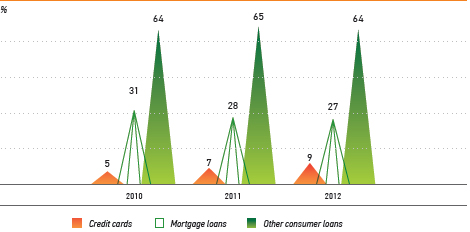

At the same time, the Russian economy’s strong consumption trend was revealed yet again in the continuing rapid expansion of retail lending, with the aggregate volume of loans to individuals increasing 39.4% y-o-yin 2012 and some consumption-oriented segments posting even higher growth. In 2H12, Russian regulators started paying increased attention to retail lending market developments, announcing plans to introduce regulations aimed at more carefully managing the risks associated with market expansion of this nature.

RUSSIAN BANKS’ RETAIL LOAN PORTFOLIO BREAKDOWN

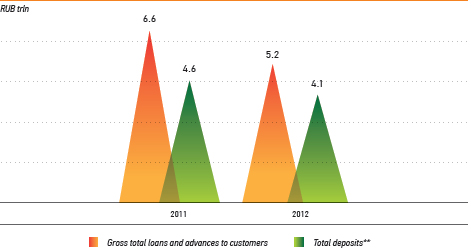

On the funding side, the Russian banking system saw a deceleration in deposit inflows in 2012, mainly driven by reduction of corporate funds inflow (—11.0% y-o-y). In the retail deposit market, the situation was more benign, with the amounts of deposits up 20% y-o-y for 2012. Despite the slower corporate lending expansion, the loan book still grew by a larger amount compared to deposit inflows with the gap being filled primarily by funding raised from monetary authorities.

GROWTH IN TOTAL GROSS LOANS AND DEPOSITS IN RUSSIAN BANKING SYSTEM

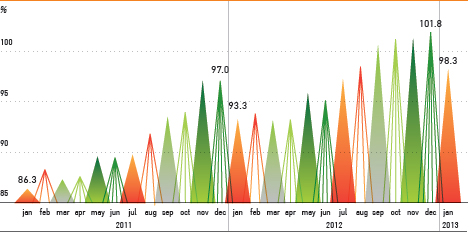

Despite a notable gap between loan and deposit growth that developed in

RUSSIAN BANKS’ AGGREGATE LOAN TO DEPOSIT RATIO

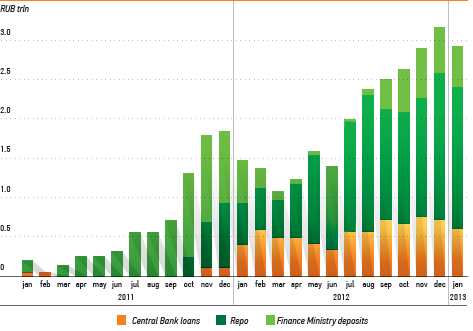

Both the Central Bank of Russia and the Finance Ministry continued operations to support li- quidity in 2012, covering banks’ needs in periods of heightened liquidity deficits. Over 2012, the overall utilization of the regulators’ funding (including funds owed to the Central Bank and the Finance Ministry) gradually increased, peaking in November 2012, while traditional year-end deposit inflow in December, driven by higher-than-average budget spending, provided significant relief for the liquidity situation.

Throughout 2012, Central Bank repo operations remained the key source of liquidity for Rus- sian banks, which has become a new norm given the shift toward a floating exchange rate and inflation targeting policy. At the same time, the regulators retain significant capacity to provide additional funding to the banks via other channels, including asset-backed lending from the Central Bank (mostly secured by loans). Given the importance of liquidity creation mechanisms under a floating exchange rate regime, the Central Bank has announced some plans to further expand the refinancing system in 2013.