Lending

In 2012, the retail business was in the spotlight for Russian entire banking system, primarily because of the rapid expansion of retail loan volumes, which brought market growth to a remarkable 39.4%.

Against such a backdrop, Sberbank was able to expand its retail loan market share, with the highest growth rate delivered by the credit card segment. On the other hand, 2012 was marked by increased competition for retail deposits, resulting in a significant uptick in funding costs for the banking system.

Alongside lending growth and competition for deposits, 2012 was a year of a very rapid development for Sberbank in both the volumes and level of transaction service provided to our retail customers. We have implemented a number of initiatives focused on expanding and developing remote service channels that have already brought a number of visible results, including strengthening Sberbank’s positions in the rapidly developing card market, alongside the introduction and successful rollout of innovative payment solutions for retail customers.

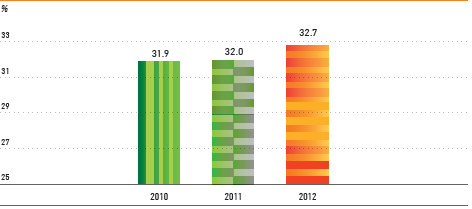

In 2012, Sberbank not only managed to keep up with the very fast pace of market growth, but also increased its market share in retail lending 0.7 pp for the year to 32.7% at year end. Although consumer loans and credit cards were the fastest-growing products, we also saw strong results in mortgage loans, which remain one of our most important products. Overall, Sberbank’s retail loan book grew 42.3% in 2012 to 2.5 trln RUB as of end 2012.

SBERBANK’S MARKET SHARE IN RETAIL LENDING

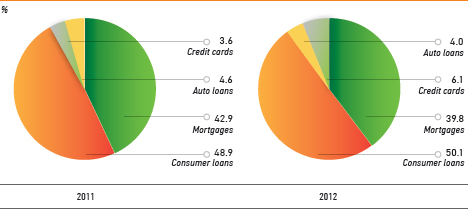

STRUCTURE OF RETAIL LOAN PORTFOLIO

Such rapid retail loan book growth was made possible by a number of technological innovations that we have put in place in recent years, including scoring solutions integrated under the Credit Factory platform. In 2012, we test-launched our Loan Middle Office project in Moscow, which is based on automated scanning of loan application forms and is aimed at freeing credit officers from performing back office functions.

Another important part of our work aimed at ensuring a high quality of service in the retail lending segment is related to streamlining loan issuance procedures, and providing faster responses to loan applications. As a result, in 2012 we managed to shorten the average loan application processing time by circa 30%.

Consumer loans

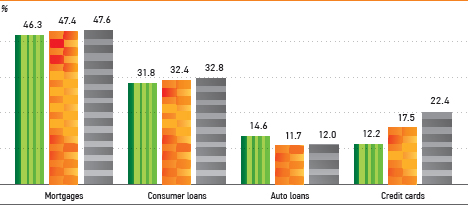

Consumer loans, representing general purpose lending, were clearly the main growth driver of retail loan book expansion for Sberbank in 2012, the annual growth rate in this segment reaching 44.6%, compared with 43.7% in 2011. Consumer loan portfolio growth at Sberbank in 2012 was slightly higher than the market growth rate. As a result, our market share in consumer lending increased circa 0.4 pp to 32.8%.

SBERBANK’S MARKET SHARE IN RETAIL LENDING BY PRODUCT

Credit cards

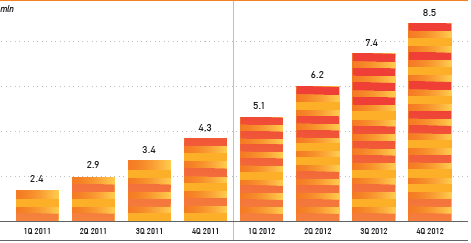

Starting from a relatively low base, our credit card business grew quickly in 2012, with the aggregate loan portfolio increasing 139% to 153 bln RUB as of end 2012. The number of credit cards issued almost doubled to 8.5 mln cards as of year end. As a result, in 2012 we took the number one spot on the credit card market.

NUMBER OF CREDIT CARDS ISSUED

Auto loans

The Russian auto loan market slowed in 2012 relative to other retail lending segments, increasing just 20.8% for the year. Sberbank’s auto loan portfolio grew 24.1%.

Mortgage loans

Mortgages remain one of our key products in the retail segment. With a market share of 47.6%, Sberbank is the undisputed leader on the mortgage market. In 2012, our mortgage portfolio expanded 31.2%, generally in line with market trends, and exceeded 1 trln RUB. Despite the high interest rate environment, we did not observe any visible deceleration in mortgage portfolio growth rates compared with 2011.

Cetelem: a new JV in consumer lending

In August 2012, Sberbank and BNP Paribas launched a joint venture in consumer lending, whereby Sberbank acquired a 70% stake in BNP Paribas Vostok for 5.2 bln RUB, the remaining 30% still owned by BNP Paribas Group. The newly acquired institution continues working under the Cetelem brand. With the acquisition of a stake in Cetelem, Sberbank aims to build up its presence in certain retail loan market segments where it is not currently present. This primarily concerns the POS and express auto loan markets, with a further aim to cross-sell other Sberbank retail products to its customers.

As of end 2012, the project was still in an early stage of development, resulting in a limited contribution to Sberbank Group’s overall retail lending business results. However, the bank delivered very high growth rates, average monthly new loan originations growing 30% in auto loans and 22% in POS loans for September-December 2012.