Corporate lending

Corporate segment remains the key part of our business, with loans to corporate customers representing 74.4% of Sberbank’s total loan book and 31.4% of client deposits on a group level as of 2012 year-end.

We also actively develop new products in transaction banking and international finance, aimed at providing our clients all services they need in order to remain their bank of choice. With the acquisition of Troika Dialog and the creation of the Sberbank CIB platform in 2012, we have also seen an increase in synergies from our investment banking operations, which has been mutually beneficial for both our traditional corporate banking business and the investment banking product line.

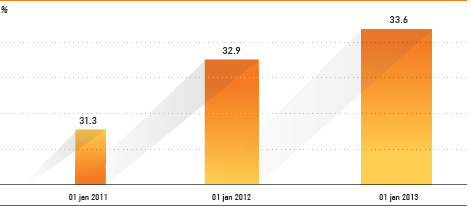

Sberbank is the largest lender to the Russian economy. In 2012, we expanded our market share in traditional corporate lending by 0.7 pp y-o-y despite strong competition in Russian corporate lending. The key factors behind the increasing competition for borrowers were softer demand for corporate loans, driven by the deceleration in economic growth, and the very rapid development of the corporate bond market in Russia.

SBERBANK’S MARKET SHARE IN CORPORATE LENDING

Nevertheless, 2012 was a record year in terms of corporate loan issuance for Sberbank. Amounts of loans underwritten in 2012 exceeded 5.9 trln RUB, increasing by circa 350 bln RUB from 2011.

Small business financing: an eventful year

In 2012, we continued to place special emphasis on the development of lending to small business. During the year we significantly extended Credit Factory platform for small business, so the volume of loans issued under this framework more than tripled, exceeding 90 bln RUB as of YE12. We also introduced innovative lending products, such as ‘Business Start’ and ‘Business Overdraft’ loans.

As a result of these initiatives and our strong emphasis on sales, lending to small clients grew 31% y-o-y, much faster than the rest of our corporate lending business.

Trade finance business

Another business that grew even faster than lending to small business was trade finance. In 2012, Sberbank actively expanded the business line, increasing the volume of the respective part of the loan portfolio 47.1% y-o-y in dollar terms to $10.5 bln as of end 2012. The number of trade finance transactions completed in 2012 exceeded 1,300, compared with 950 in 2011. Sberbank’s international expansion, including the acquisition of banking businesses in Switzerland, CEE and Turkey, has allowed us to develop a product offering for our clients that involves our international subsidiaries and allows us to service all our clients’ needs. In recognition of our efforts in this field, Sberbank was named “The best trade finance bank in Russia and CIS for 2012” by Global Trade Review Magazine.

Loan yields gradually increased in second half of 2012

In 2012 two contradicting factors drove corporate loan yields in Russia. On one hand, there was high competition for borrowers amid softer demand for credit; on the other, relatively tight liquidity conditions precluded yields from falling sharply. Against this backdrop, effective loan yields in 2012 remained steady in 1H12 and started picking up slightly in 2H12. This reflects the bank’s ability to adjust its lending policy in accordance with market conditions, maintaining a constant focus on preserving interest margins. This also reflects the increasing proportion of SME loans with higher yields in the total corporate loan portfolio.

Improved loan book quality

In 2012, despite a slowdown in economic activity in Russia, we did not observe any significant signs of deterioration in our loan book quality. The share of non-performing loans in our corporate portfolio decreased in 2012 from 3.6% to 2.9% (according to management accounting, OJSC Sberbank standalone), not only as a result of the growing portfolio, but also due to a decrease in overdue loans in absolute terms.