Loans and advances to customers

The Group’s total gross loan portfolio increased 32.0% y-o-y to 11.1 trln RUB, including newly consolidated banks. Without the acquisitions, the portfolio expanded 20.5% in 2012.

BREAKDOWN OF GROSS LOANS AND ADVANCES TO CUSTOMERS

|

2012 |

2011 | |||

| RUB bln | % total | RUB bln | % total | |

| Commercial loans to legal entities | 5,281.5 | 47.8 | 4,012.9 | 47.9 |

| Specialized loans to legal entities | 2,946.3 | 26.6 | 2,563.7 | 30.6 |

| Consumer and other loans to individuals | 1,569.7 | 14.2 | 944.0 | 11.2 |

| Mortgage loans to individuals | 1,143.4 | 10.3 | 777.4 | 9.3 |

| Car loans to individuals | 123.4 | 1.1 | 84.2 | 1.0 |

| Total loans and advances to customers before provision for loan impairment | 11,064.3 | 100 | 8,382.2 | 100 |

In 2012, retail loans increased 57.1%. This large growth is partially explained by the acquisitions of VBI Group, DenizBank and Cetelem. Excluding the influence of these acquisitions, retail loans still demonstrated a remarkable growth rate of 42.2% for the year.

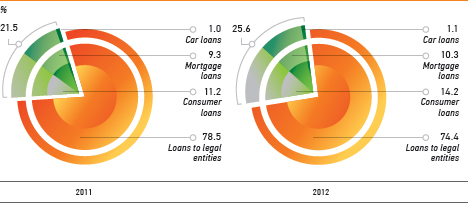

Corporate loans increased 25.1% in 2012. Excluding the acquisitions, they grew 14.8%. As a result, loans to individuals increased to 25.6% of total gross loans in 2012 versus 21.5% in 2011.

STRUCTURE OF THE GROUP’S GROSS LOAN PORTFOLIO

Despite the rapid expansion of the retail portfolio, its quality remained high, with the share of non-performing loans in total gross loans to individuals declining to 2.7% by end 2012 versus 3.0% the year before. This result is attributable to the acquisition effect and to the improvements in risk-management systems and a conservative lending policy.

In 2012, we successfully increased underwriting of loans to all categories of clients, especially in the SME segment (a 32.8% y-o-y increase of the portfolio, or 12.5% excluding acquisitions). These efforts resulted in a decline of exposure to the Top 20 clients to 19.3% of total corporate loans at end 2012 from 23.3% in 2011.

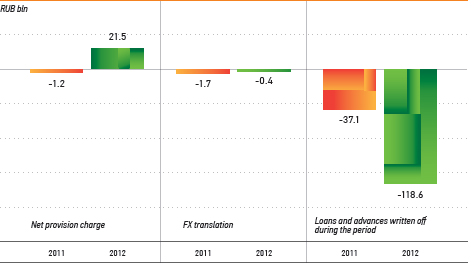

Corporate loan quality remained solid with the proportion of non-performing to total corporate loans declining to 3.3% by end 2012, compared with 5.4% the year prior. This reduction is the result of an intensive workout of problem loans, as well as large write-offs that mostly occurred in the first part of the year and totaled 118.6 bln RUB for 2012 versus 37.1 bln RUB in 2011.