Interest expense

The most important factor that influenced the Group’s interest expense in 2012 was the shortage of liquidity in the Russian banking system, the main market for the Group, where customer lending was growing faster than deposits.

|

RUB bln |

2012 |

2011 | ||||

|

Average amount for the period | Interest expense

% | Average cost | Average amount for the period | Interest expense | Average cost | |

| Due to individuals | 6,224.5 | 262.5 | 4.2% | 5,129.1 | 211.0 | 4.1% |

| Due to corporate customers | 2,676.0 | 90.5 | 3.4% | 1,906.6 | 36.5 | 1.9% |

| Subordinated debt | 327.9 | 20.9 | 6.4% | 310.7 | 19.5 | 6.3% |

| Other borrowed funds | 313.2 | 6.9 | 2.2% | 195.4 | 4.2 | 2.1% |

| Debt securities in issue | 483.6 | 25.1 | 5.2% | 267.8 | 12.8 | 4.8% |

| Due to banks | 928.1 | 46.6 | 5.0% | 158.6 | 5.6 | 3.5% |

| Total | 10,953.3 | 452.5 | 4.1% | 7,968.2 | 289.6 | 3.6% |

| Other liabilities | 305.5 | 165.4 | ||||

| 11,258.8 | 8,133.6 | |||||

Though the Central Bank of Russia had significantly extended volumes of liquidity it provides to Russian banks by means of its market instruments, high demand brought a general increase in interest rates on customer deposits and borrowing in the money market. This led to a noticeable increase in cost of funds for The Group.

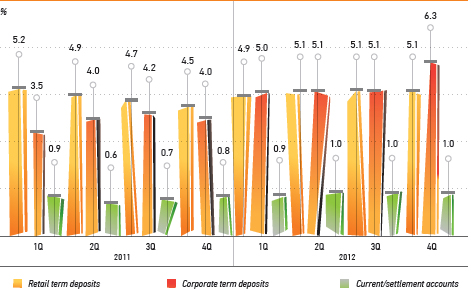

Funds from retail customers remain the core item in the liability structure. Due to an increased share of current accounts, the cost of total retail funds increased by just 0.1 pp to 4.2% in 2012.

|

RUB bln |

2012 |

2011 | ||||

|

Average amount

|

Interest expense

|

Average cost |

Average amount

|

Interest expense |

Average cost | |

| Term deposits | 1,348.5 | 73.7 | 5.5% | 658.4 | 26.0 | 3.9% |

| Current accounts | 1,327.5 | 16.8 | 1.3% | 1,248.2 | 10.5 | 0.8% |

| Sub-total | 2,676.0 | 90.5 | 3.4% | 1,906.6 | 36.5 | 1.9% |

| Due to individuals | ||||||

| Term deposits | 5,072.4 | 253.7 | 5.0% | 4,288.8 | 205.8 | 4.8% |

| Current accounts | 1,152.1 | 8.8 | 0.8% | 840.3 | 5.2 | 0.6% |

| Sub-total | 6,224.5 | 262.5 | 4.2% | 5,129.1 | 211.0 | 4.1% |

| TOTAL | 8,900.5 | 353.0 | 4.0% | 7,035.7 | 247.5 | 3.5% |

The cost of corporate deposits increased by 1.5 pp, mostly driven by higher costs of corporate term deposits. Furthermore, average annual amount of these deposits doubled in 2012.

Interest expenses on sums due to banks reached 46.6 bln RUB in 2012 compared with 5.6 bln RUB in 2011. This increase is explained by large borrowings from the Central Bank of Russia, the largest liquidity provider for the market. The average cost of funds from other banks was 5.0% in 2012 (versus 3.5% in 2011).