Transaction services and fee income

Among other achievements in our retail business in 2012 was the expansion of our bank card and transaction business, which resulted in growth of both volumes of serviced transactions and fees generated by this business line. The overall numbers of transactions substantially increased, which was accompanied by a structural shift in operations toward non-cash.

The combination of these factors, which were all made possible by extensive investments in service quality, resulted in 28.3% growth in retail transaction business fees, including 56% growth in bank card operation fees. Thus, bank cards became our single largest fee revenue source, having more than doubled over the last two years. We outline the key drivers of retail fee and commission income below:

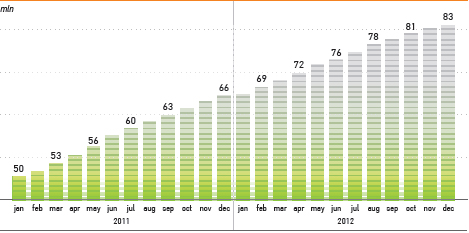

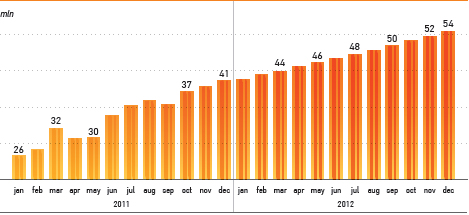

GROWTH IN NUMBER OF CARDS ISSUED

NUMBER OF ACTIVE BANK CARDS

The number of active bank cards issued by Sberbank has almost doubled since the beginning of 2011 to 54 mln by end 2012.

Increasing client activity

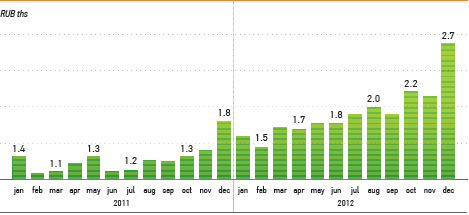

In 2012, we observed a significant pickup in cardholder activity, which was a key factor behind growing bank card fee income. Compared with 2011, average monthly trade turnover per active card increased 44% (not including less productive cash withdrawal transactions), reaching 2.7 ths RUB per month in December 2012.

MONTHLY TRADE TURNOVER PER ACTIVE CARD

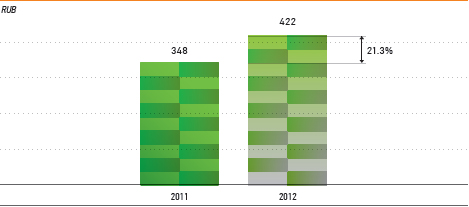

ANNUAL COMMISSION PER CARD

The more active use of bank cards resulted in higher fee revenue per card in 2012, which rose 21.3% y-o-y.

A higher share of non-cash card transactions

We saw a continuing increase in non-cash transactions via our bank cards in both 2011 and 2012. The share of these transactions reached 29% in 2012 and as much as 33% in December 2012, compared with a 22% average for 2011. This trend made a significant contribution to our fee revenues in the bank card business and to growth in the balances our customers keep on their bank cards.

Other transaction business products

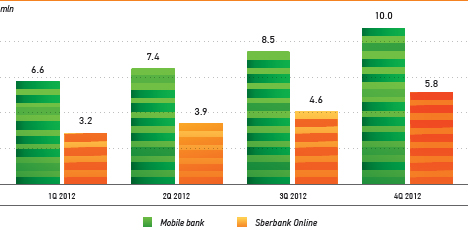

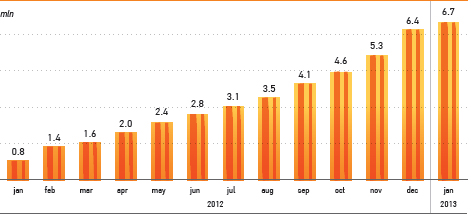

Our strategic target is to increase the proportion of services provided to our customers using Sberbank’s remote channels. To further this goal, we have developed a number of remote service channel platforms. Sberbank Online, our internet banking platform, continued to deliver strong performance in 2012, with the average number of active clients growing by 3.4 mln. Revenues generated by our mobile banking service were up 62% on the back of more customers using the service and executing more transactions via this service.

NUMBER OF ACTIVE CLIENTS OF MOBILE BANK AND SBERBANK ONLINE

NUMBER OF AUTO-PAYMENT SERVICE USERS

In addition, Auto-Payment, our newly introduced automated billing service, posted very solid growth, with the number of clients using it to pay for mobile phone services increasing by circa 6 mln in 2012.