Retail deposits

Amid tight liquidity conditions in 2012, competition for all funding sources intensified, with the retail deposit market becoming one of the most competitive segments overall. This resulted in a significant increase in the average cost of term retail deposits.

One of Sberbank’s key priorities remains the active management of funding costs, as we aim to minimize the impact of adverse market conditions on our margins while still maintaining competitive lending rates across all our products and business lines. On the back of increased competition for retail funding in 2012, we had to raise our interest rates payable on retail term deposits. Since our target was to limit its impact on our aggregate funding costs and margins, this resulted in slower retail deposit growth versus the market and a 0.9 pp drop in our share of Russian retail deposit market, which fell to 45.7% as of year end.

New products and service improvements

One of the most significant technological developments in our retail deposit business was the introduction of online deposits in 2012. These represent a new channel of raising deposits via our internet bank and ATMs, which allows us to save on operating costs. As of year end, the total volume of online deposits was 97 bln RUB.

Another important development in our retail funding platform in 2012 was the further expansion of our savings certificate program. As a product, these certificates have a number of important features. They are not covered by the deposit insurance scheme and thus exempt from its costs. Unlike retail deposits, which by Russian law are callable at any moment, savings certificates are repaid upon maturity. This product is aimed at individuals with high net worth. Our portfolio of deposit certificates grew from a very low base of 9 bln RUB at end 2011 to 222 bln RUB as of end 2012.

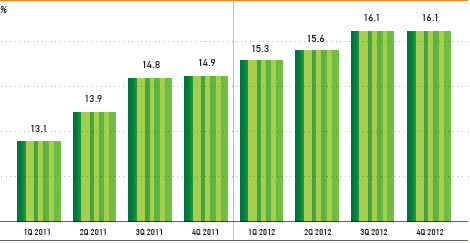

A very important accomplishment in our retail deposit portfolio was a structural shift toward current accounts, represented mainly by bank card account balances. Their share increased from 14.9% to 16.1% of total retail deposits (15.6% including saving certificates into total customer deposits). This helped us partially make up for the effects of rising interest rates on term retail deposits on the overall cost of retail funding. Our growth rate in current retail accounts stood at 24.3% in 2012, significantly exceeding the 15.2% rate posted by the rest of the banking system.

SHARE OF CURRENT ACCOUNTS IN RETAIL DEPOSITS

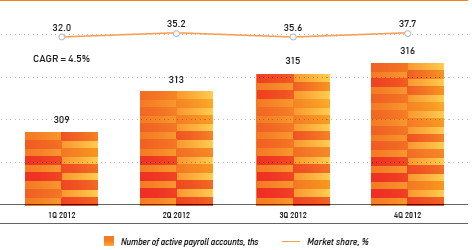

This achievement was made possible by our growing market shares in the highly competitive salary payment and pension payment markets. Our efforts toward expanding remote service channels, including continuous improvements in internet and mobile banking services, also played a critical role in bringing retail current account balances to Sberbank.