Corporate deposits

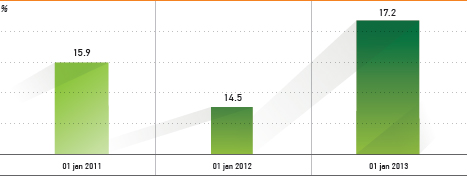

In view of tight funding conditions in the Russian banking system in 2012, Sberbank significantly increased its focus on corporate funding compared with 2011. In 2012, we delivered a robust 74.9% increase in corporate term deposits. As a result, our market share in corporate funds expanded 2.7 pp to 17.2% by end 2012.

SBERBANK’S CORPORATE FUNDS MARKET SHARE

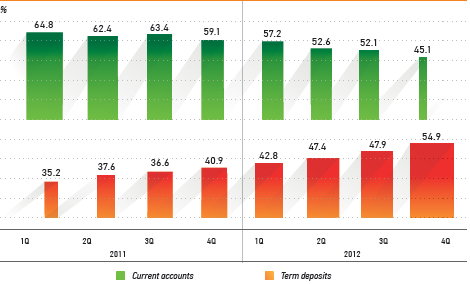

Most of this growth came from term corporate deposits across all major client segments, while the volume of less expensive current accounts remained largely unchanged. The lack of growth in current corporate accounts at Sberbank mirrors the situation in the Russian banking system in general.

BREAKDOWN OF CORPORATE DEPOSITS

Our strategy, aimed at attracting significant additional amounts of term corporate deposits in 2012, was to a great degree driven by the banking system’s liquidity situation, which became increasingly tight in 2H12. As a result, we extended usage of this funding source, which is demonstrated above. This decision was made for the following two main reasons:

- we kept a significant emergency liquidity buffer and

- raising corporate deposits remained a more cost-efficient option compared with sources of Central Bank financing from a funding cost management standpoint.

Our balance sheet and liquidity management are discussed in more detail in the Financial Review section of this report.