Net interest income

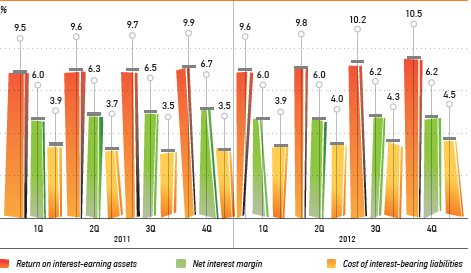

Net interest income earned in 2012 totaled 704.8 bln RUB, increasing 25.6% for the year (or 20.4% excluding 2012 acquisitions).

The net interest margin declined by 0.3 pp y-o-y to 6.1%. The margin was negatively affected by

- the rising share of relatively expensive corporate term deposits, which increased the absolute figure for interest expenses as well as the ratio of interest-bearing liabilities to interest-earning assets;

- increased debt from other banks that is dominated by relatively expensive repo loans from CBR; and

- decreased yields on loans. On the other hand, increased share of loans in interest-earning assets structure supported NIM.

THE FOLLOWING FACTORS AFFECTED NIM IN 2012

close

| 2011 NIM | 6.4% |

| Return on corporate loans | — |

| Return on retail loans | -0.1% |

| Return on amounts due from other banks | — |

| Return on securities | 0.1% |

| Structure of interest-earning assets | 0.3% |

| Costs of amounts due to corporate customers | -0.3% |

| Costs of amounts due to individuals | -0.1% |

| Costs of amounts due to other banks | -0.1% |

| Costs of issued securities and subordinated debt | — |

| Structure of interest-bearing liabilities | — |

| Ratio of interest-earning assets to interest-bearing liabilities | -0.1% |

| 2012 NIM | 6.1% |