Interest income

In 2012, the Group’s interest income increased 36.1% to nearly 1.2 trln RUB. Most of this growth came from the expansion of the Group’s loan portfolio, which supplied 96.4% of the growth in interest income for the year.

|

Rub bln |

2012 |

2011 | ||||

|

Average amount for the period |

Interest income |

Average yield, % |

Average amount for the period |

Interest income |

Average yield, %

| |

|

Loans to corporate customers |

7,284.8 |

693.8 |

9.5 |

5,416.0 |

518.2 |

9.6 |

|

Loans to individuals |

2,348.9 |

343.8 |

14.6 |

1,495.2 |

223.6 |

15.0 |

|

Due from other banks |

426.9 |

6.7 |

1.6 |

371.6 |

7.0 |

1.9 |

|

Debt securities |

1,588.9 |

113.0 |

7.1 |

1,523.9 |

101.8 |

6.7 |

|

Total |

11,649.5 |

1,157.3 |

9.9 |

8,806.7 |

850.6 |

9.7 |

Growth of interest income was driven by the expansion of volumes of earning assets and by the increase of high yield products in interest earning assets.

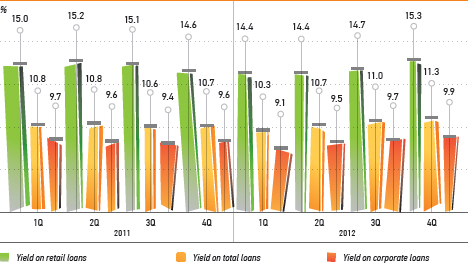

As the table above demonstrates, average yield on loans declined in 2012. The average yield on total earning assets increased from 9.7% to 9.9%, however, because of faster growth of loans, especially retail loans that have the highest yields of all asset classes.