Small Business Support

Small business support is the objective with the highest social effect. Public and social importance of developing this business rests on the fact that small businesses make up the foundation of sustainable economy and offer an effective tool to ensure self-employment of households and create the middle class population. This line of business is among our strategic priorities and a good example of close interlace between business interests and social objectives.

The bank’s concept of small and micro business development includes the following tasks:

- to win leading positions on the small business market;

- to offer small businesses a wide range of financial and non-financial services;

- to expand the network of business development centres;

- to set up effective cooperation with public and social institutions responsible for supporting small and medium businesses, and with professional business associations

In 2012 the bank made considerable progress in developing the product range:

- the programme of small unsecured loans based on the scoring model (The Credit Factory) designed for mass micro segment (with an average financing of 900,000 rooubles and

3-year maturity) was brought to its full capacity. The Trust loan offered under this programme proved to be the most popular product among small businesses exercising an important social function of making financial resources available to Russian small businesses (see the diagram).

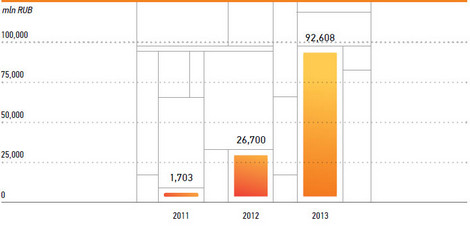

SBERBANK’S SCORING-BASED LOANS TO SMALL BUSINESSES (LOAN PORTFOLIO)

- In September 2012 the Express-auto product (a loan to finance vehicle acquisition for personal and business needs) was launched under the Credit Factory programme; since July 2012 the Express-asset product (a loan to finance equipment procurement) is offered in a test mode.

The Credit Factory

- In 2012 the number of borrowers under the Credit Factory programme rose from 42,500 to 114,000 (nearly 170% growth YTD).

- The number of Trust loans exceeded 120,000.

- The Credit Factory loan portfolio tripled year-to-date exceeding 90 bln RUB while maintaining high loan quality.

- In 2012 Sberbank launched the Business Start loan product designed for first-time entrepreneurs, based on franchising technology. The bank offers to finance up to 80% of the project value for a period of up to 42 months. A free multimedia training business course is available on the bank’s web-site, the franchisors participating in the project also support the development of a new business. When offering this product to the market, we came across a number of restrictions connected, first of all, with the selection of franchisors for the project. It slowed the pace of implementation but allowed to preserve the quality of the offer.

The Business Start

- The Business Start package is continuously expanded: as of the year-end it included over 50 ready-made solutions.

- In December 2012, the bank issued 35 loans under the Business Start programme, and the project continues to expand. We can say that we launch a new business every day .

- The bank received more than 5,000 requests, over 800 loan applications out of which 100 applications were approved.

- The Business Start product is offered in 77 Russian cities.

Success story of a start-up

Over half a year ago, Oksana Kapralova of Togliatti used the Business Start programme to open a Subway fast food restaurant. Together with her husband, she decided to start her own business and approached Subway Russia with an offer to open a restaurant in her city. When she learned that the restaurant was a participant in Sberbank’s Business Start programme, she took training in restaurant business and obtained a 2.41 mln RUB loan from Sberbank.

The family invested in their new business about a million of their own funds.The restaurant opened in summer 2012 — a month and a half after the loan was granted. The first month of operation brought about 400,000 rooubles. That was not net profits though. Nearly 70% of revenues fall on business costs: rent payments, employee salaries, food procurement, and loan repayment. Still, general business performance allowed the Kapralovs to plan the opening of the second restaurant, even despite a number of minor difficulties.

The reality made certain corrections to their plans: In October 2012, after four months of operation, Oksana decided to relocate her restaurant to another business centre with higher traffic to raise the visitor flow. The relocation required another investment of her own funds. Still, in November her revenues rose, and in December reached 550,000 roubles. Today, Oksana is an advisor to other business people that plan to join the Business Start programme to open their own Subway restaurant. Franchisors are also interested in start-ups to expand their networks.

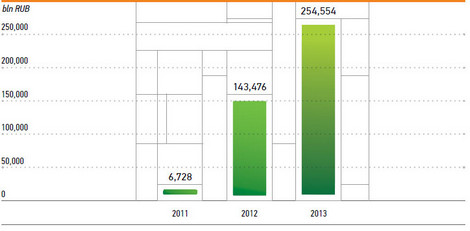

- As of the year-end, the bank’s Business product line generated a total loan portfolio of more than 255 bln RUB, with a growth of over 70% (see the diagram). This programme is designed for the businesses that have a well-established sustainable operation.

SPECIALIZED LOAN PRODUCT LINE BUSINESS (LOAN PORTFOLIO)

- In 2012 the bank launched the Business Project, a pilot product designed to finance the expanding and upgrading of the client’s operating business (i.e. investment lending) as well as business diversification and opening new lines of operation (project finance). In 2012 the bank financed over 80 projects worth nearly 2 bln RUB under this pilot programme. The project was approved and in 2013 will be used throughout the bank.

- In 2012 the bank improved the conditions of a number of current loan products including Government Order, Business Confidence, Business Revenue.

Developing small business lending is among the most prospective lines of business development with a high growth potential.

The Business Environment — new Business Philosophy

To achieve the goal of providing small businesses with a range of financial and non-financial services, in 2012 the bank launched the Business Environment programme . The programme is operated by the bank’s subsidiary ZAO Business Environment. The operator’s main objective is to ensure fast development of the programme through continuous launching of new projects. Achieving this objective will require the creation of a business culture that would correspond to “business environment” of small businesses .

The Business Environment is a unique web-based platform (http://dasreda.ru) which provides business people with a wide range of services including networking, latest news, professional advice, special training, access to banking services and a lot more.

THE BUSINESS ENVIRONMENT PRIMARY SERVICES

| Services | Description | Examples |

|---|---|---|

| School | Video courses and entrepreneurial skills tests offered

in the format of distant business learning |

|

| Shop | Sale of business applications and business services in the Software as a Service (SaaS) format; online requests for the bank’s products and services |

|

| Magazine | Latest news and feature stories published in online business magazine |

|

| Club | Search for reliable partners among Sberbank clients |

|

| Trading platform | Online trade with Business Environment

participants, etc. |

|

For information purposes: Business Environment performance in 2012:

- 65,000 registered users;

- 50,000 registered businesses;

- 1,700 products and services sold;

- 24 training courses at the Business School;

- 20 SaaS-applications in the Shop.

New quality in working with small businesses

We have identified several lines of raising the quality of small business services:

- Creating Business Development Centres (BDC) that will offer not only financial products and services but also comprehensive advice on a wide range of issues connected with business organization and development;

- Developing and improving the quality of remote services.

Our goal is to ensure that every small business client is offered an effective and comfortable cooperation through any of the service channels available. At the same time, in 2012 the bank paid special attention to improving operation of customer service outlets since over

70% of small business clients visit the bank’s offices two or more times a month.

In 2012 we launched a comprehensive system of evaluating the quality of interaction with corporate clients through all key channels of cooperation at every stage of service that will allow to timely identify problematic issues and respond with corrective measures.

We have also adopted the Uniform Small Business Service Standards, included the service quality evaluation in the employee motivation system, launched a training programme for all employees and office managers.

Key achievements in 2012:

- a dedicated support line for Sberbank Business OnLine users created,

- complaint handling period shortened more than 4 times — from 17 to 4 business days,

- average waiting time at the bank’s call centre reduced from 2 minutes to 15 seconds.

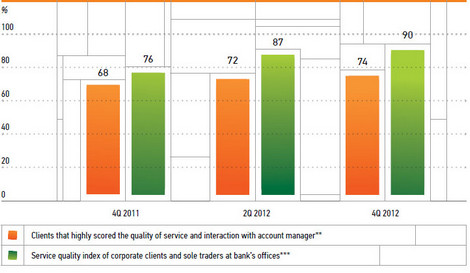

While the quality of service at the bank’s offices improved considerably in 2012, our regular research Client Voice shows that there is still a good potential for raising the quality of small business services:

- share of clients satisfied with the work of account managers rose to 74%;

- service Quality Index of corporate customers and sole traders at the bank ’s offices increased 14 ppt reaching 90%.

SMALL AND MICRO BUSINESS SERVICE QUALITY PERFORMANCE AT BANK’S OFFICES

In addition to measuring service quality, we pay special attention to studying real-life problems that prevent the development of small businesses. We are committed to developing our own business based on our understanding of those problems and possible solutions (see Table below). Of course, the bank is not in a position to solve all those problems but understanding the needs of our clients enables us to focus on their requirements.

oj compliance with the bank’s corporate service standards