Improving quality and reducing queues

Improving the quality of client service is among the bank’s top priorities in the business development strategy.

In raising the quality of retail service we seek to achieve the following objectives:

- developing and improving complaint management;

- reducing queues;

- implementing the new model of CSO development.

COMMUNICATION CHANNEL

In 2012 we also continued developing the system of evaluating the service quality at all stages of client relationships as well as client satisfaction with the bank’s products and services.

Complaint Management

The key line of raising the quality of service in 2012 was a thorough study of the client feedback obtained through various channels of communication, and improving the bank’s processes to meet client expectations.

The bank has introduced the Uniform Complaint Management System. The system’s technological process involves a review of client complaints by corresponding experts. Complaint reasons and the channels of their communication are thoroughly analyzed. The results are regularly reported to the bank’s management, technological processes are regularly upgraded.

Establishing the Customer Care Service became an important part of organizing the complaint management system. Its tasks include locating client complaints on the web, interacting with clients, and analyzing the issues that gave rise to complaints. Based on analytical data, Customer Care Service will identify faults in the bank’s business processes and prepare proposals to correct them which will result in higher quality of client service.

For example, last year the Service’s effort resulted in:

- cancelling a commission fee for cash withdrawals in Moscow and the Moscow Region;

- adding an option to select the English language to ATM functions;

- adding an option of unrestricted early repayment of loans.

Client complaints in 2012

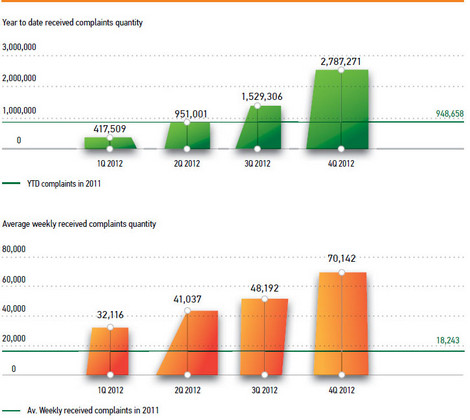

RECEIVED COMPLAINTS DYNAMICS

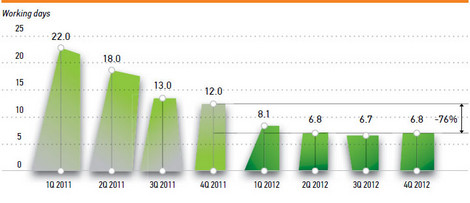

AVERAGE DURATION OF COMPLAINT REVIEW

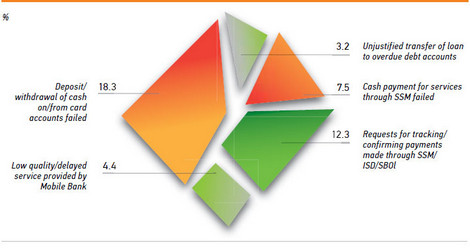

WHERE ISSUES STEM FROM

TOP 5 PROBLEMS

No Queues!

Reducing queues at customer service outlets was among our greatest priorities. In 2012 we set an ambitious target: 90% of clients must wait in queues less than 10 minutes at 90% of customer service outlets. We achieved this target in December 2012: 92% of clients wait in queues less than 10 minutes at 92% of the customer service outlets equipped with the Queue Management System (QMS).

This important achievement became possible due to implementing the No.Queues! programme. The programme success largely relies on implementing the crowdsourcing project No.Queues! on Sberbank’s platform at http://sberbank21.ru.

2012 achievements of the No.Queues! programme:

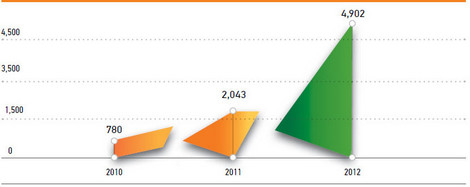

- by the end of the year, QMS-equipped customer service outlets nearly doubled reaching 4,902 points;

- over 85% of Queue Management Systems are connected to the QMS Monitoring System which allows to obtain real-time data of queues for Sberbank as a whole and by its customer service outlets;

- over 50% of pensioners serviced by the bank use social bank cards to receive pension payments which enables them to reduce the time they have to wait in queues.

Generally, the level we achieved allows to mitigate the queue problem. Nevertheless, we intend to continue our effort to provide fast and quality banking service to our clients.

The next stage in the process of raising the service quality involve optimization of internal processes at the customer service outlets, improving employee skills and system of motivation. For these purposes, in 2012 the bank launched a new project to implement a new operations model that covered 3,801 customer service outlets (69% of all CSOs with the staff above 6 employees). In 2013 the new model will be introduced at all large customer service outlets.

POINTS OF SERVICE EQUIPPED WITH QUEUE MANAGEMENT SYSTEM

The crowdsourcing project No.Queues!

The project was launched in August 2012.

Objective: find new solutions designed to remove/prevent causes of queues at the bank that will allow for fast reduction in queue time to 10 minutes and less without considerable financial investment.

5,947 participants participated in the project; 1,137 ideas proposed; 7 ideas recognized winners. Key queue factors analyzed and main causes identified. Solutions how to fight queues proposed. The best ideas selected:

- jump over the queue: a green corridor for Sberbank clients;

- Sberbank.Flow: monitoring through web-site;

- real-time map on Sberbank’s web-site and on the screen at every customer service outlet;

- placing bar-code on savings book;

- mobile bank for deposits with corresponding information packages;

- an option to make payments through self-service machines in one installment;

- developing test programmes to train transaction officers.

Client satisfaction research

In 2012 we continued our effort to develop the system of evaluating client satisfaction with our services rendered through various channels (Unified Distributed Contact Centre, customer service outlets, partners, agents, etc.)

Along with quarterly checks of service quality at mass segment, in 2012 we launched service quality monitoring at the mass high-income client segment, completed the audit of external and internal condition of customer service outlets and self-service, and made basic measurements of client satisfaction with agent and partner sales channels.

In 2012, for the first time our clients participated in studying convenience and accessibility of the information system of the Unified Distributed Contact Centre (UDCC) and helped introduce first quality changes. We have launched the Mystery Calling project to evaluate the performance quality of the UDCC employees. It helped us identify and correct problems in operators’ performance, especially in tangled/non-standard situations.

To detect and remove system-level problems in existing products and services, the bank established the Retail Service Quality Commission which identified problems in the quality of services provided through remote channels. The entire effort resulted in the first step on the way to creating a round-the-clock support service for remote channel clients: we have completed a pilot project that was used to develop a plan and determine resources for its further development in 2013.

Quality index performance, service standards compliance index

Our continued effort to improve the quality of retail services brought the following results:

- quality index at customer service outlets reached 92% though the evaluation criteria were tougher than in 2011, demonstrating a 15% growth vs. 2011 (similar evaluation criteria);

- by the end of 2012, the share of the customer service outlets that received excellent rating reached 73% demonstrating annual growth of 17%.

performance criteria: customer care, attention to client needs,

skills and knowledge.

Service Standards Compliance Index is used to evaluate

performance of the bank’s service standards.